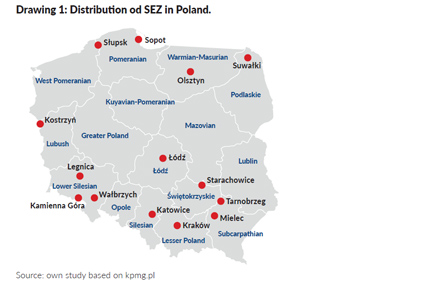

Special Economic Zones (SEZ) are the selected areas of Poland where investors are exempted from income tax in reference to income gained in a particular zone. In fact, there are 14 special economic zones in Poland. At the end of 2014, the area amounted to nearly 18134 ha in aggregate. In September 2015, it rose to 18687 ha, thus, systematically increasing year by year without changing the number of zones as such. They are located in 162 cities and 232 communes. They perfectly suit to those, who will to start investment project on the territory of Poland. These zones are created mainly in areas with considerable demand for work and large workforce. Since the main purpose of such zones is to boost economy and give jobs, they seem to be a great place for implementing investment. It allows for minimizing costs of employment or costs of a new investment. Moreover, mostly companies from modern industries are operating in SEZ, which gives a possibility to interact as far as business and investments are concerned.

In the SEZ area, the entrepreneurs can benefit from tax exemption due to bearing costs of new investment and creating new vacancies. The level of support depends on maximum intensity of help planned for the places where investment is realized. For entrepreneurs who will take advantage of vacancy-related benefits, there is a grant covering the costs of 2-year work of a new employee. In case of entrepreneurs who will decide on investment-related help, cost of new investment is covered.

At the beginning of 2015, there were 2056 business licenses in force in all 14 special zones. In 2014, there were issued 436 licenses, which constitutes more than 21% of total number of licenses. It indicates about big support, provided to national and foreign investors. At the end of 2014,entrepreneurs, which were running business in such zones, invested over PLN 101.9 billion and provided around 395.6 thousand vacancies, of which nearly 2013.9 thousand (i.e. 72%) referred to new vacancies created by investors after being awarded a permit to run business in the zone, which directly resulted from realisation of new investments.